Methodology

Introduction

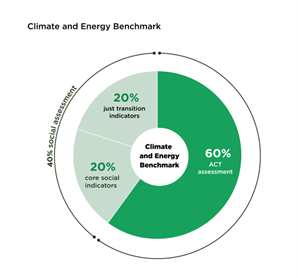

The 2023 Climate and Energy Benchmark of the oil and gas sector is the second iteration of this benchmark. This second iteration brings together the assessment of companies’ climate strategy and performance together with social performance in the same benchmark and ranking. The performance on climate is examined through an Assessing Low-Carbon (ACT) assessment. Social performance is examined through the just transition indicators (JTI), and core social indicators (CSI). For more details on the methodology please see the methodology report below.

See methodologyScope

In 2022, global GHG emissions related to energy amounted to roughly 40 Gt CO2. Operational emissions from the oil and gas industry added up to 5.1 Gt CO2, meaning that this sector was directly responsible for almost 15% of total energy-related emissions (IEA, 2022). Consequently, companies from this sector are highly relevant to be included in WBA’s benchmarking process.

The activities of the oil and gas sector can be divided into the three main steps of the value chain (see WBA Oil and Gas 2023 methodology report):

- Upstream segment, mainly linked to exploration, production and processing

- Midstream segment, mainly linked to transport and refining

- Downstream segment, mainly linked to distribution and retail.

Of the 100 assessed companies, a large majority of them (83) operate across more than one segment: 64 are qualified as fully integrated (covering the three segments of the value chain) and 19 as semi-integrated (covering two segments of the value chain). Among the other 16 companies, 12 are pure upstream players, four are pure midstream players, and not a single one is a pure downstream player.

Approach to scoring and ranking

ACT assessment

A score is given per indicator which is used to calculate the performance element of the ACT score. The narrative assessment is then produced by analysing the company against the four narrative criteria. Data from the performance assessment as well as other verifiable public data on the company such as annual and sustainability reports and news from reliable sources is considered. Finally, the trend score is produced synthesising the forward-looking aspects of the assessment to consider whether the company’s performance would improve, stay the same or worsen if assessed again in the near future.

To create the ACT rating score, a weighting was applied to each of the performance, narrative, and trend scores as follows:

- The performance score has a 1:1 weighting, i.e., a score of 12 is 12;

- The narrative score is weighted: A=20, B=15, C=10, D=5, E=0; and

- The trend score is weighed: “+”=2, “=”=1, “-“= 0.

Social transformation assessment

The just transition methodology is based on 6 indicators (JTI), which are all scaled on 2 points. JTI 1 and JTI 2 are double-weighted while all other ones (from JTI 3 to JTI 6) are single-weighted.

The core social indicators (CSI) are scaled on 1 point. They all are single-weighted, except CSI 4 and CSI 5 which are double-weighted.

Figure: Total benchmark ranking scores

Aggregation of scores

ACT, CSI and JTI scores are set to 60%, 20% and 20% of the total score respectively. This overall weighted score results in the Oil and Gas Benchmark 2023 ranking.

Total figures for assessments can be subject to rounding differences, but this has not had any overall effect on the ranking.

Read our FAQ

Data collection process

The Oil and Gas Benchmark 2023 assesses the most reliable, latest available, public and verifiable data. Trends in past performance of the company are analysed over five years before the reporting year. 2022 was the most recent year for which complete regulatory data was available, meaning quantitative datapoints were taken from 2017 to 2022.

Data was collected in the first instance from CDP’s disclosure platform where possible, as well as other sources such as specialist databases and public materials from company websites including sustainability and corporate responsibility reports.

Companies were also invited to directly participate in the data validation process by submitting information during a two–week period between April and May 2023.

All 100 companies were welcome to provide additional information; 35 provided additional data either through the data validation process or by other means within the time period.

See the data set