Key finding

Companies are failing to assess and disclose their impacts and dependencies on nature

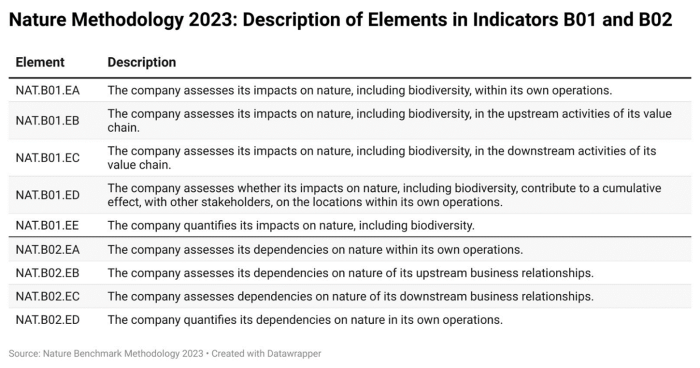

The 2023 Nature Benchmark provides an analysis of how many of 380 of the most influential food and agriculture and paper and forest companies are assessing their impacts on nature (indicator B01) and evaluating their dependencies on nature’s contributions (indicator B02) (Table 1).

Aimed at understanding how corporate activities are interconnected with ecosystems and species, these indicators underscore the necessity for companies to understand their reliance on nature, and recognize and mitigate their impacts on biodiversity.

Table 1. Description of Elements in Indicators B01 and B02 in Nature Benchmark Methodology 2023.

Table 1. Description of Elements in Indicators B01 and B02 in Nature Benchmark Methodology 2023.

Although inherently tied to nature, food and agriculture and paper and forest companies overlook impacts and dependencies

Although we are in the midst of a sixth mass extinction , only 2% (9 out of 380) of the assessed companies disclose their environmental impacts, and none comprehensively address and disclose their dependencies on nature. This gap is concerning, as it reveals a lack of understanding and transparency about the extent of companies’ interactions with nature.

The hidden costs of nature loss are substantial, and only through comprehensive assessments can companies understand and mitigate these risks. This lack of transparency and acknowledgment of these impacts and dependencies may have serious economic and environmental consequences, highlighting the urgent need for a paradigm shift in corporate accountability and stewardship.

Leading practices and useful frameworks

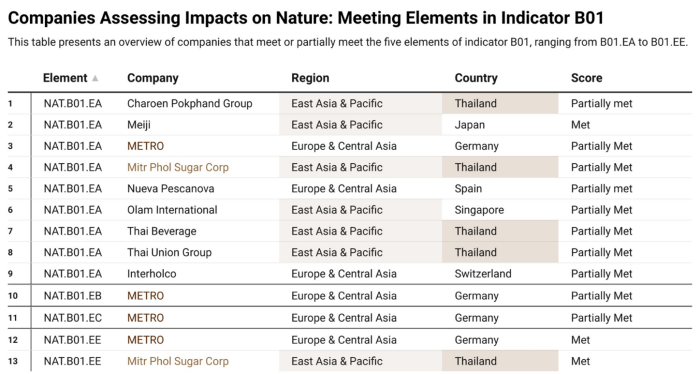

The nine companies that disclosed their environmental impacts have employed varied methodologies in assessing and disclosing their impact on nature (Table 2). Meiji, Charoen Pokphand Group, Olam International and Thai Union Group notably use the Integrated Biodiversity Assessment Tool (IBAT) and frameworks like the Taskforce on Nature-related Financial Disclosure (TNFD) to assess their impacts. Metro offers monetary estimates of its environmental impacts, while Mitr Phol and Thai Beverage focus on risk impact assessments and critical habitat assessments, respectively. Nueva Pescanova conducts environmental impact studies on biodiversity by independent entities, and Interholco emphasizes forest conservation through its FSC monitoring reports . Utilizing these frameworks provides a structured and consistent approach for companies to gain a comprehensive understanding of their impact on biodiversity and ecosystems. This enables them to reduce negative effects and align their business strategies with global sustainability goals, thereby fostering practices that contribute to a sustainable future.

However, there’s room for improvement in these practices. Most of these companies can enhance transparency by disclosing more comprehensive results of their assessments and extending their assessments to cover all operational areas.

Table 2. An overview of companies that meet or partially meet the five elements of indicator B01, ranging from B01.EA to B01.EE. Companies that meet multiple elements are displayed in unique colors. Additionally, companies from the East Asia & Pacific region are highlighted with a light grey background in the “Region” column, while those from Thailand are distinctly marked with a light brown background in the “Country” column. See Nature Benchmark Dataset 2023 for all data.

Many other companies are starting their journey

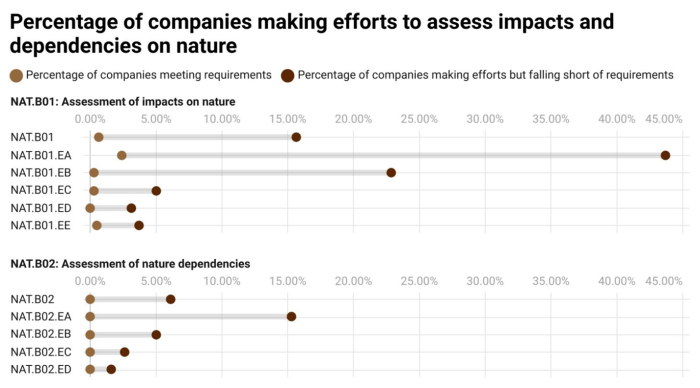

There are some signs that momentum is growing, as many other companies show evidence of beginning to look at their relationship with nature, but in a way which falls short of meeting the requirements of the indicators in our benchmark. 44% of companies are beginning to adopt some practices to assess their impact on nature and 15% are starting to evaluate the dependencies on nature of their own operations (Figure 1). Common shortcomings include not covering all operations, not disclosing full results, or not providing transparent methodologies . However, these companies have begun to lay the foundation for a comprehensive assessment and disclosure of their impacts and dependencies on nature. This suggests that they are well-placed to adopt or align with credible frameworks such as the recommendations of Taskforce on Nature-related Financial Disclosures (TNFD).

Figure 1. Percentage of companies making efforts to assess impacts and dependencies on nature. For description of the elements, see Table 1.

Figure 1. Percentage of companies making efforts to assess impacts and dependencies on nature. For description of the elements, see Table 1.

The importance of robust environmental policy: the Thai example

Among the nine companies globally disclosing their impacts on nature, four are headquartered in Thailand (Table 2). This disproportionately high performance can be likely attributed to Thailand’s environmental regulatory framework , which includes Environmental Impact Assessment (EIA) Regulations (1978, strengthened in 1992), the National Biodiversity Policy (2009), and the Draft Biodiversity Act (2019). These four Thai companies, constituting 57% of all Thai companies included in this assessment, have conducted thorough biodiversity assessments that align with local policies, showcasing how national regulations can effectively drive corporate environmental responsibility and promote best practices.

For instance, Charoen Pokphand Group and Thai Union have integrated comprehensive biodiversity assessments into their operations, aligning with the EIA’s requirements. Charoen Pokphand Group’s participation in the World Business Council for Sustainable Development (WBCSD) and its adoption of the natural capital assessment framework underscore a strategic integration of ecosystem considerations into business risk strategies. Similarly, Thai Union’s extensive use of IBAT for evaluating biodiversity risks across its operations demonstrates a pioneering approach in the food and agriculture sector.

Conclusion

The findings from the Nature Benchmark underscore the urgent need for companies to conduct more comprehensive and transparent environmental assessments. Although expectations and legislation on environmental impacts and dependencies have lagged behind other, more mature topics such as carbon emissions, these are now catching up. A useful framework that companies can use to address these gaps is the LEAP (Locate, Evaluate, Assess, and Prepare) approach, developed by the TNFD. This method provides a structured process for identifying, evaluating, and managing nature-related issues. Through peer learning, following guidance from frameworks like TNFD, and understanding the expectations from the Global Biodiversity Framework , companies now, more than ever, must get to grips with how they affect and rely on nature – and use this insight to make decisions that minimize their negative impacts and enhance their positive influence on nature.

Insights authored by Xuelai Wang in collaboration with the Nature Benchmark Team