Regional finding

Key findings for Eastern and Southern Africa

The Access to Seeds Index highlights the efforts of seed companies to improve access to seeds for smallholder farmers in emerging economies. Small-scale farmers often lack opportunities to access farm inputs and can benefit significantly from increased knowledge, technology, and resources that companies can provide. The index seeks primarily to identify leadership and good practices across the seed industry, providing an evidence base for discussing where and how companies can step up their efforts.

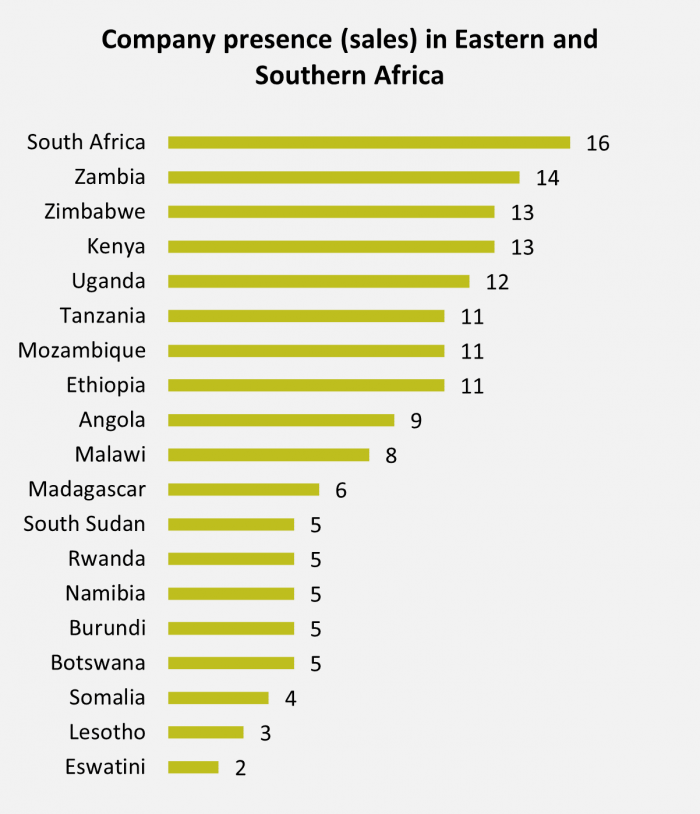

The efforts of the 32 companies are evident through the offer of diverse and broad crop portfolios of important global and traditional crops to smallholder farmers in all 19 index countries. There are two or more companies reporting a sales presence in each country. However, only 13 companies report on extending their sales presence to remote rural areas that are difficult to reach, often due to lack of road infrastructure.

Beyond sales, companies have to train farmers on adopting new technologies through extension services. In 2021, companies now have extension services present in all index countries, which is four more countries than in 2019. But the distribution of these training services is disproportionate and too few farmers benefit in those countries where companies are present.

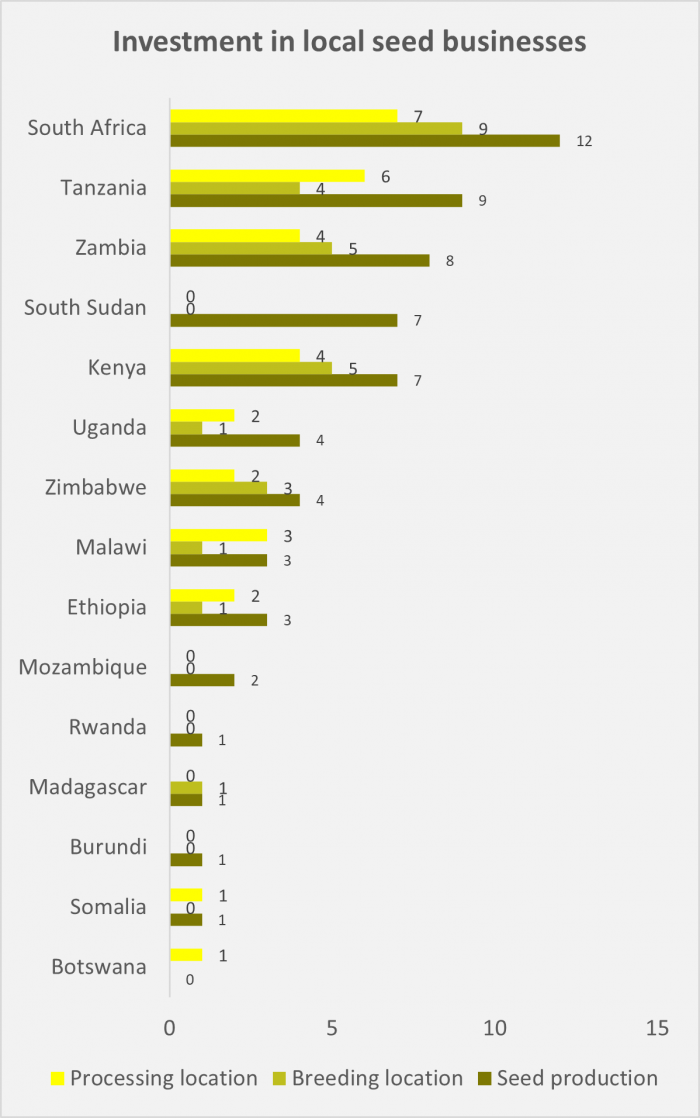

Overall, the industry’s efforts to develop the local seed sector, such as breeding programs, seed production, and seed processing, continue to be concentrated in few countries (8). To ensure that the seed industry adheres to and respects social and labour standards, the index particularly evaluates the performance of seed companies investing in seed production in the region where they tend to contract local players to support these activities. The results show that companies lack adequate systems to ensure social and labour standards across seed production activities.

Although companies invest in their presence in the region and target smallholder farmers as important clients, there is scope of improvement across the six measurement areas. The index provides a road map on leading practices, risks and opportunities to accelerate their efforts and increase transparency to enable knowledge sharing and focused improvement actions.

Companies are present across index countries but can increase their reach to remote areas

In Eastern and Southern Africa, companies show strong efforts to reach smallholder farmers with sales in all 19 index countries and two or more companies in each country. However, only 13 companies report reaching remote rural areas with sales for smallholder farmers.

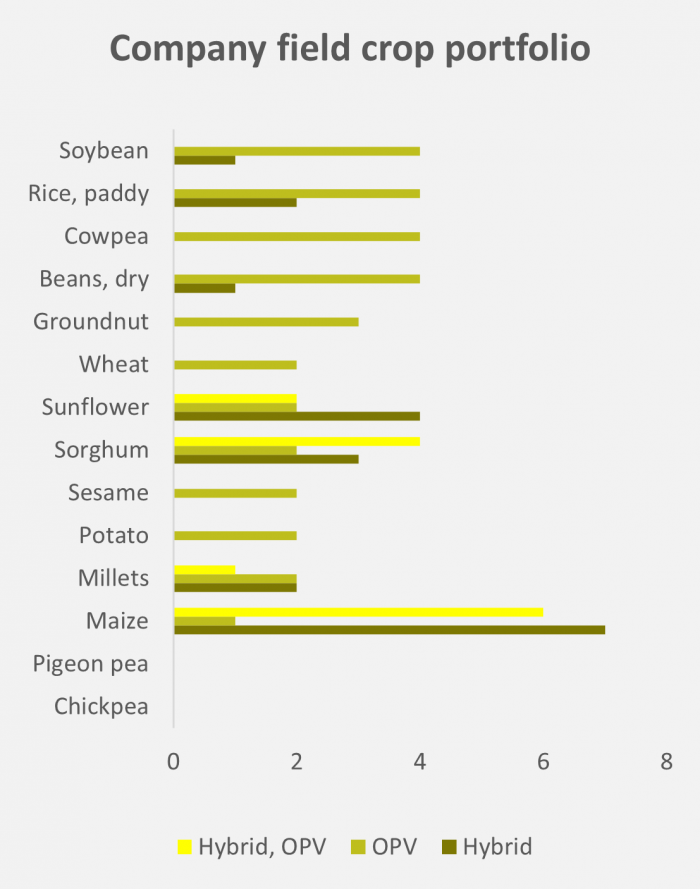

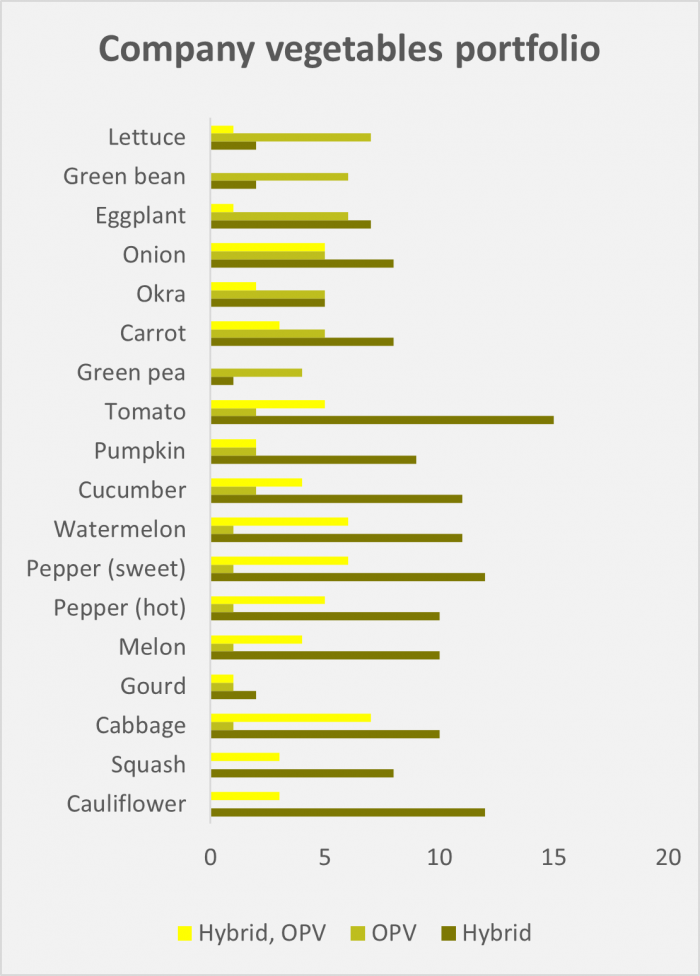

Crop portfolios are broad, diverse, and newer

Company portfolios in Eastern and Southern Africa are diverse for vegetable and field crops, with maize still the most popular for many companies. In addition, companies continue to offer more Open Pollinated Varieties than hybrids preferred by smallholder farmers, and they are introducing newer varieties on the market than in 2019.

60% of the companies invest in smallholder farmers adopting improved agriculture technologies, but efforts are geographically disproportionate

60% (19) of the companies report supporting their sales with extension services to smallholder farmers in all index countries, which has improved coverage since 2019. But these company efforts are still geographically disproportionate, as the 2019 and 2016 regional indexes reported.

Eight countries benefit most from the seed business investments in the region

In Eastern and Southern Africa, companies invest in local seed business activities such as breeding, seed production, and seed processing in 15 countries, but these efforts are concentrated in eight countries. Seed production is a common business activity, although only ten companies contract smallholder farmers, offering additional income and knowledge-sharing opportunities. Nevertheless, companies lack effective systems to monitor performance to comply with their workers’ social and labour rights in seed production.