2021–2024 in review: Lessons on corporate climate preparedness

Our analysis of four years of assessing corporate transition plans on their integrity and credibility highlights the gaps, the frontrunners, and the levers that can accelerate corporate action

By Hang Dang, Maria Patricia Gonzalez, Mingyang Hao and Sebastian Carcoana

As the world looks ahead to COP30 in Belém in 2025, governments are preparing to put new Nationally Determined Contributions (NDCs) on the table. NDCs show us where governments intend to go – but our assessments of corporate transition plans reveal whether the real economy is ready to deliver.

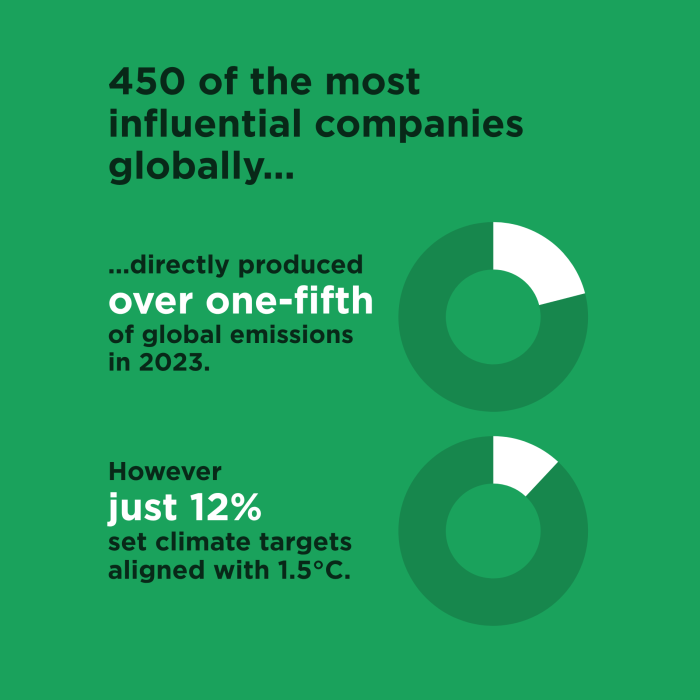

Between 2021 and 2024, the World Benchmarking Alliance assessed 450 of the world’s most influential companies in carbon-intensive sectors on their readiness for the low-carbon transition. These companies are hugely influential. They:

- account for at least 21% of global emissions (2023)

- employ 27 million people (roughly the population of Australia)

- generate revenue equal to more than four-fifths of the EU economy

This retrospective analysis looks back at what we’ve learned from these assessments. It highlights four insights that can guide companies, investors, and policymakers as we enter the decisive second half of the decade.

1. 10 years after the Paris Agreement, credible climate targets are still rare, even among leaders

Despite growing climate awareness, only 12% of companies we assessed have targets consistent with limiting warming to 1.5°C. To count as credible, targets needed to cover direct (Scope 1 &and2) emissions and show at least 75% alignment with a 1.5°C pathway. Even among perceived leaders, most emissions fell outside meaningful targets. And even then, most of their emissions remain outside credible targets. Ambition is rising, but credibility is still the missing piece.

2. Few companies are supporting workers and communities in the transition

The transition to a low-carbon economy will reshape industries and livelihoods – yet very few companies are making sure their workers and communities are supported along the way. Only 26% of these workers are even covered by a company commitment to meaningful social dialogue with unions or worker representatives.

And when it comes to deeper commitments – ensuring access to green and decent jobs as part of the transition – the picture is even starker. Just 7% of workers are covered, across a small set of companies: BP, ENGIE, Eni, Naturgy Energy, OMV, Origin Energy, Repsol, Rosneft, Saras, Sasol, TotalEnergies, Viva Energy, SK Innovation, AEP, EDP, EDF, Enel, Eskom, Iberdrola, PG&E, Southern Co, SSE, Polska Grupa Energetyczna, Holcim, South32, ArcelorMittal and Ford.

These leaders tend to be from sectors most likely to be affected by the transition.

3. Progress is uneven across sectors and regions

To make sense of company performance, we grouped them into three categories: Leaders, Followers, and Laggards. Rather than relying on subjective judgments, we used a data-driven approach that looks at both numbers (like companies’ climate targets and social scores) and consistency of narratives and trends in their strategies.

This allowed the data itself to reveal natural groupings:

Leaders – Companies that are committed to the climate transition by setting credible targets and implementing compelling transition plans. At the same time, these companies demonstrate strong performance in their social practices, be it by engagement with the workforce or planning for a just transition.

Laggards – Companies that show little to no commitment to the climate transition, reflected in inadequate or absent targets and a lack of transition planning. In addition, these companies consistently score in the lower range on social performance metrics, including just transition.

Followers – Companies that fall between the two previous groups, showing some level of commitment to the climate transition but lacking the comprehensive targets, plans, or social performance that characterise the leaders.

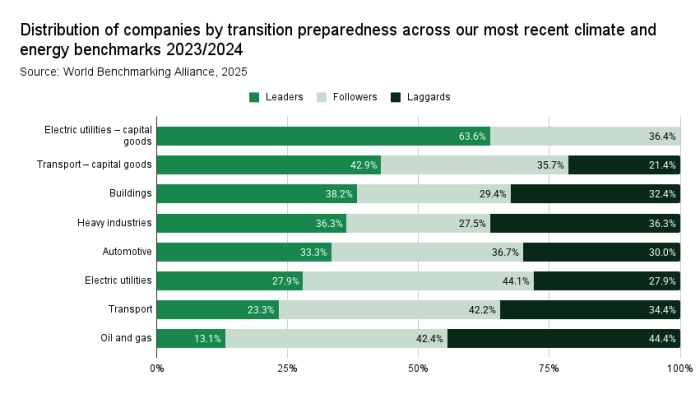

Our analysis showed stark differences across sectors:

- Electric utility companies are clear frontrunners: 64% classed as leaders, no laggards.

- Automotive and transport manufacturers show momentum, with 78% moving in the right direction – though the sector is deeply split between EV leaders and combustion laggards.

- Oil and gas companies are the furthest behind, with 44% of companies classed as Laggards and only 13% as Leaders.

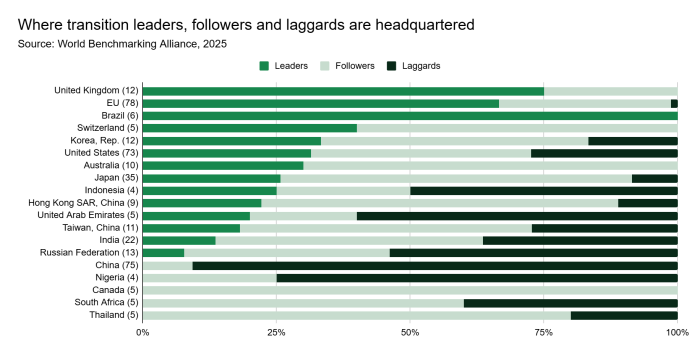

Regionally, the EU, US, UK and Japan are home of the headquarters of the most climate leaders (in terms of absolute volume). The United States illustrates the contrasts: pioneering companies sit alongside complete laggards, making it both a leader and a laggard globally. In China, India, and other emerging economies, the majority of companies assessed remain unprepared for transition, highlighting steep hurdles to overcome.

4. Five levers can accelerate climate preparedness

We ran a regression analysis to test which actions had the strongest link to climate preparedness. Five indicators stood out as having a significant positive effect on the odds on a company in a more climate prepared group:

- Developing a robust low-carbon transition plan (+36.7%)

- Taking a clear stance on climate policy (+25.9%)

- Linking executive incentives to climate outcomes (+17.6%)

- Supporting customers to cut emissions (+16.8%)

- Consistently reducing Scope 1 and 2 emissions (+9.8%)

Our results suggest that even laggards can become leaders in the short to medium term if they focus on the right levers:

- Short-term focus: strengthen planning, policy engagement, and governance.

- Medium-term focus: continue refining planning, engagement and governance, as well as deliver emissions cuts and help customers decarbonise.

Looking ahead

The insights from 2021–2024 are more than a retrospective. They set a critical baseline for understanding progress to date. They show what’s possible, what’s lagging, and which levers can help companies accelerate.

In 2026, we will publish the results of an expanded assessment of 2,000 of the world’s most influential companies – examining their alignment with 1.5°C pathways, the strength of their transition plans, and the scale of low-carbon investments.

And just before COP30, we will publish initial insights based on the first 1,000 companies of this group. This will provide the most up-to-date snapshot yet of global transition readiness, and show how far the private sector has come since these 450 companies were first assessed.

As governments prepare new NDCs, the message is clear: accountability cannot stop at national borders. Businesses must step up, adopt credible transition plans, and act decisively in this decade of delivery.

Methodology note

This analysis draws on the Assessing low-Carbon Transition (ACT) methodologies, alongside WBA’s Just Transition and Social indicators, applied to 450 companies in high-emitting sectors between 2021–2024. Each sectoral benchmark is publicly available, and the unified dataset is now compiled for cross-sector analysis.

Download the data setLearn more about our efforts to assess companies on the integrity and credibility of their transition plans.

Our climate work