What does the Corporate Sustainable Reporting Directive mean for the Global South?

Adopted in November 2022, the Corporate Sustainability Reporting Directive (CSRD) is a gamechanger for corporate reporting. It will radically transform the information available on the impact of companies on the environment and society.

While the landmark directive primarily focuses on EU-headquartered entities, non-EU multinationals may be in scope under specific circumstances. This extraterritoriality will largely affect companies from developed countries, such as the United States or Japan. However, some influential companies from the Global South will also have to comply with the new disclosure requirements for which they are potentially less prepared. What effect will it then have on the most influential companies in developing economies?

Which non-EU companies are in scope?

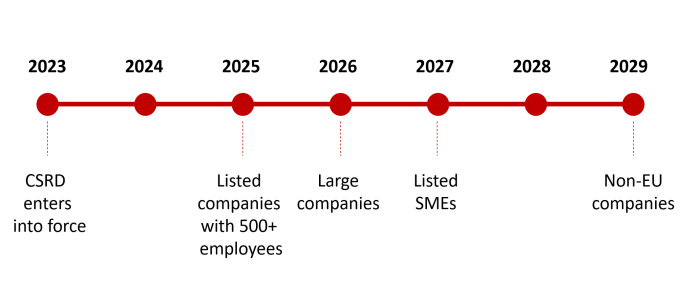

The CSRD came into force in January 2023 and will be phased in progressively. Large EU-listed companies which were subject to the outgoing EU non-financial reporting rules will be required to start reporting sustainability information from the 2024 financial year – with the report to be published in 2025. The next phase will include the large EU companies and small to medium sized enterprises (SMEs) listed in the EU. Finally, large non-EU companies will be brought into scope, and will need to comply starting in the 2028 financial year – with the report to be published in 2029.

However, the element of extraterritoriality introduced by the new EU legislation may deserve a deeper analysis for the non-EU groups. Distinct situations may arise depending on the way they interact with the EU market and, while the dedicated standards have been delayed, non-EU companies potentially in scope should already start preparing for the new regulation.

There are three main means by which non-EU entities can be in scope of the CSRD namely EU listed securities, significant activity in the EU and in-scope EU subsidiaries.

Which non-EU companies may be directly impacted?

Assessing whether a non-EU group or an EU subsidiary is in the scope of the CSRD can be a complex exercise, especially for non-EU entities from emerging and developing economies. A study of the most influential companies can help provide some clarity. The World Benchmarking Alliance examines the world’s 2000 most influential companies, known as the SDG2000. These 2,000 companies hold dominant positions in their respective industries with operations and supply chains spanning the globe.

Among these, 734 are headquartered in emerging and developing economies (see map below), giving a sizeable sample. From those, our analysis shows that at least 42% (310) are in scope of the CSRD. Given the number of companies in the dataset which have a global footprint but for which insufficient data was found, more than 50% will likely be in scope.

These findings do not indicate in any shape or form that a deluge of non-EU companies from the Global South will be in scope of the CSRD. Rather, they reveal that the SDG2000, given its focus on the most influential companies globally, is a suitable tool to analyse the impact of the CSRD on emerging and developing economies.

Which companies are not CSRD-ready?

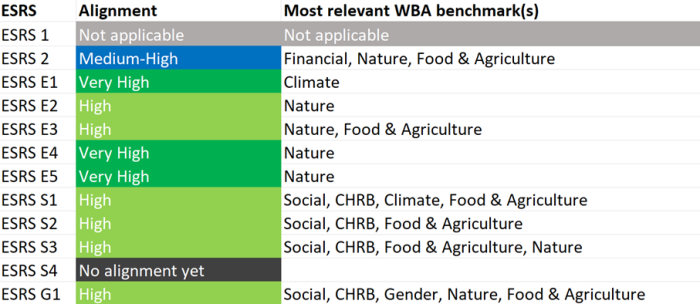

Companies from the Global South can often be the least prepared to the extraterritoriality effect of the CSRD. Our different benchmarks are well aligned with the disclosure requirements of the new legislation (see ESRS alignment below), thus allowing a solid assessment of companies’ preparedness to the CSRD.

Based on this analysis, less than 30% of the companies identified as potentially in scope are on track to report (79 out of 277 as there are companies which we have yet to analyse). Conversely, more than 70% of the most influential companies from developing economies will most likely need to significantly increase their level of disclosure in order to reach the level of details required by the European Sustainable Reporting Standards (ESRS).

Preparedness seems to vary among industries. For instance, about 16% (six out of 36) of in-scope oil and gas companies from developing markets are showing appropriate level of reporting, a comparable percentage to the food production companies (four out of24) and a few other industries. The percentage is particularly striking when looking at banks and other financial institutions, with only three out of 35 banks (8.5%) and none of the other financial institutions in scope showing an adequate level in their sustainability disclosures.

(Table Notes: Blank means N/A as too few companies were represented in the sector. Not all industries are equally represented).

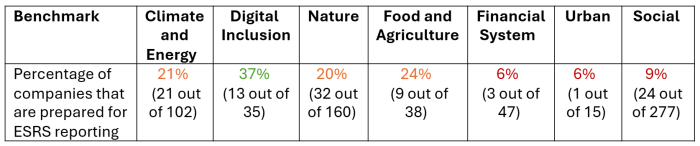

These findings are best summarized when looking at our respective benchmarks. Companies assessed in the Digital Benchmark seem overall best prepared, notably as 42% (six out of14) of telecommunications companies show the necessary level of preparedness. This percentage hovers above 20% for companies assessed in the Climate and Energy Benchmark, Nature Benchmark and Food and Agriculture Benchmark. Finally, companies in the Financial System Benchmark and Urban Benchmark appear as the least prepared to report, with only 6% reaching the level of details required by the ESRS.

Conclusion

The low level of preparedness for large companies headquartered in emerging and developing economies requires swift action from businesses to ensure compliance with the CSRD. Capacity building will be essential especially where companies are new to sustainability reporting (highlighted in -dark- red in the provided excel).

Our publicly available data can be used by both potentially in-scope companies from developing countries to clarify their disclosure gaps as well as international organisations and multilaterals to inform their interaction with them. For instance, multilateral development banks can provide technical assistance on the CSRD disclosure requirements to their clients covered by the directive. Initiatives like the International Finance Corporation’s Beyond the Balance Sheet can also guide emerging-market companies to better tackle new disclosure practices.

Action by world’s most significant companies, as identified by the SDG2000, will be key for a sustainable future. The CSRD offers a starting point to significantly accelerate the transformation of the world’s most significant companies – within or outside of the EU.