How UNGA’s financing meeting can help the world build forward stronger

Missing from the unprecedented virtual launch of the 75th session of the UN General Assembly (UNGA) this year were diplomats downing coffees in hallways between meetings, activists frantically scouring for special-event passes and the collective groans of New Yorkers waiting for motorcades to pass. Nevertheless, the myriad policy debates and commitments so characteristic to UNGA, even if through computer screen this time, were no less important for the future of our planet.

The 29 September “High Level Event on Financing for Development in the Era of COVID-19 and Beyond,” hosted by Canada and Jamaica as well as UN SG António Guterres, marked an inflection point as a case study of the convening power and influence of the UN amidst a tough moment for multilateralism. As trillions in capital from investors will play a major role in determining the trajectory of how businesses adopt sustainable and inclusive policies; scale innovation and best practices; and empower the world’s most vulnerable communities amidst the impacts of COVID-19, it is difficult to overstate the importance of getting financing for development right.

During the UNGA meeting, a “menu of options,” (the Menu) with hundreds of policy actions pertaining to financing Agenda 2030 and building forward stronger from COVID19 were presented to global heads-of-state. The Menu was informed by a multi-month, multi-stakeholder, and multi-sector consultation process. The request from one UN ambassador: “be brutally pragmatic.”

The World Benchmarking Alliance participated in two thematic “Discussion Groups” (out of six) during the consultation process that kicked off last May. The first grouping we engaged focused on “External finance and remittances, jobs and inclusive Growth” and was chaired by Bangladesh, Egypt, Japan, and Spain with coordination from UNDP. The second centered on “Recovering better for sustainability,” and was chaired by the EU, Fiji, Rwanda, and the UK with coordination from UNCTAD.

During a series of salon-style meetings over the summer, WBA offered a series of recommendations and observations under the common thread of global standards for sustainability. Specifically, WBA cited the value proposition of boosting transparency from the community, including financial and non-financial disclosure. WBA coupled these recommendations with calls for a gender-lens approach to financing for sustainable development, benchmarking climate and decarbonization efforts, and replicating regional leadership such as that of the EU Non-Financial Reporting Directive.

Overall, the Menu presented to head of states shows the widespread agreement on the need for transparency and leadership from business in their commitment to Agenda 2030. These include shifting financing into low-carbon inclusive and resilient investments, with the SDGs front of mind, and bringing investment portfolios and compensation structures into alignment with them. This would amount to a strategic shift in intent and capital allocation for many globally influential financial institutions, and a clear signal to companies as to what’s expected in their own business models, ranging from gender inclusion to human rights due diligence in supply chains.

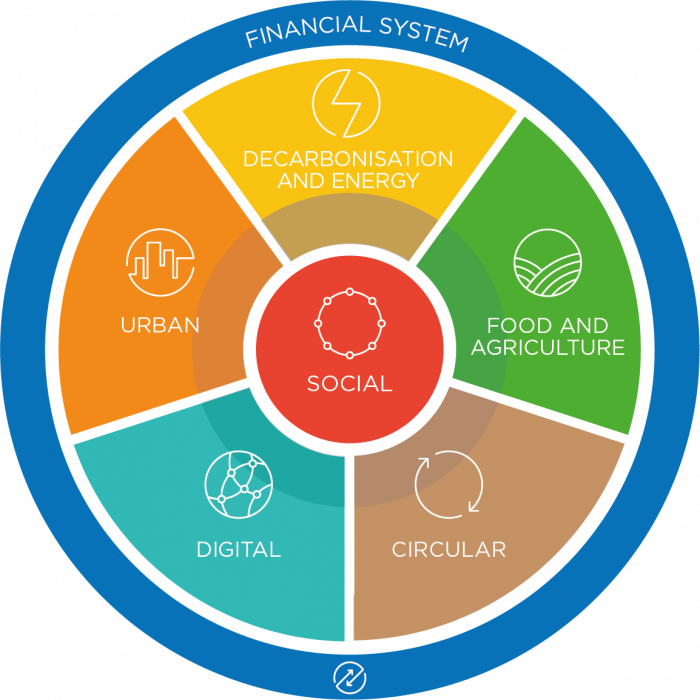

For WBA, transforming the financial system represents a cross-cutting enabler for the 2030 Agenda.

Governments, in turn, have been asked to ensure the right standards and disclosure frameworks are in place to incentivize such shifts. The WBA was specifically referenced as a means to encourage the private sector to implement these recommendations. For the World Benchmarking Alliance, transforming the financial system represents a cross-cutting enabler for the 2030 Agenda, including the multiple “systems-level” changes required to get it right, ranging from food and agriculture to digital inclusion. To this end, WBA will rank 400 of the globe’s most influential financial institutions on their contribution to the SDGs with the release a baseline Financial System Benchmark by 2022 that will be free and publicly available for all.

The UNGA High-Level Financing Meeting’s ability to spark a business unusual transformation is far from guaranteed. As many diplomats participating in the consultations were careful to reiterate, the text does not represent a consensus document nor is it an official negotiated text. Balancing depth versus breadth in policy options, including ensuring applicability to specific regional contexts and national situations, is another asterisk in the Menu. Finally, there is a risk of short-term-driven backsliding on both sustainable investment and corporate leadership on sustainability.

Stakeholders from all sectors should therefore take four steps to jumpstart action, forge enterprising partnerships, and deliver tangible results:

- Project political will and accountability: As the Menu declares, “Political leadership at the highest levels is now needed to take this initiative forward and translate unprecedented levels of ambition into concrete action . . . The time to act is now.” As more than 50 heads of state from every world region kickstarted this ambitious process during of this year and even more dignitaries participated in the High-Level UNGA meeting, there is zero excuse for foot-dragging. Similarly encouraging is the fact that 1,290 corporate leaders from 100 countries put pen to a paper on an UNGA statement affirming “inclusive multilateralism” and the SDGs. Actions, of course, will be speak louder than any words or text.

- Fast-track forum engagement: Other major global and regional forums – whether the G7, G20, International Monetary Fund, EU, ASEAN, UNFCCC COP, World Economic Forum, and Paris Peace Forum – should take steps to align their agendas and assess progress on the Menu. In doing so, forums like the G20 and G7 should emulate the characteristic commitment to inclusion in the High-level Financing for Development consultation process. It would supercharge accountability, and assist with contextualizing policy options to particular regions, identifying issue-specific gaps should they emerge.

- Invigorate investment aligned with the SDGs and System Change: According to the Menu, “the transition towards sustainable-development-oriented investment in developing economies is so far not happening at the necessary scale and pace” and a “big push to mobilize and channel investment towards the SDGs is urgently needed.” But there’s good news too as the Menu acknowledges, “Sustainability can be fully integrated along the entire investment chain and across public and private markets, and more sustainability-themed capital market products dedicated to the SDGs could be developed.” Investors – whether individual savers, pensioners, banks, insurance companies, or sovereign wealth funds – are invited to review WBA’s benchmarks to reward those businesses that are leaders and engage with those that are laggards.

- Double down on inclusive consultations: The UN and relevant UN member state co-leads should either renew or replicate the consultative “Discussion Group” process that helped assemble the Menu. These refreshingly candid and salon-style meetings represent exactly what is need in this challenging global context that demands unconventional alliances and silo breaking. Future iterations of the Discussion Groups might cover implementation of the Menu at more granular levels, but also other areas with transformative potential for Agenda 2030 such as the SDGs – human rights nexus.

According to the Social Progress Index, should 2020 trends continue, the SDGs will be out of reach until 2082. Given this startling assessment, the UNGA High-Level Event Financing for Development Meeting presents the baseline ambition for kickstarting a global economic transformation to recover stronger together for the Decade of Action.