Unlocking Asian Sustainable Business: Highlights from our Allies Assembly Finance Day

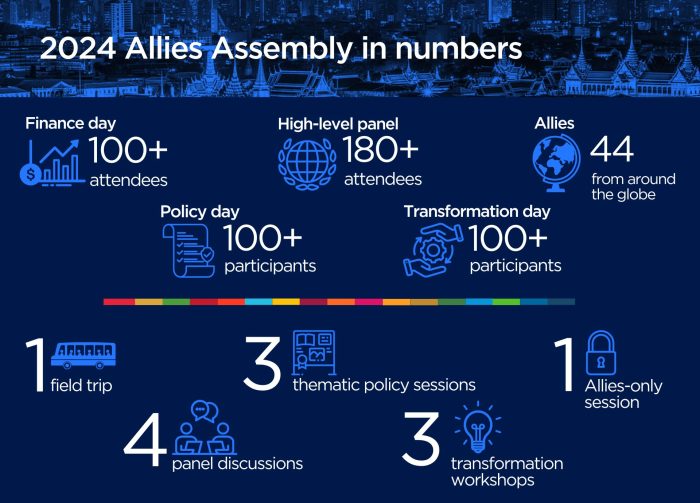

In June 2024 World Benchmarking Alliance proudly hosted our flagship global sustainability conference – the Allies Assembly – in Bangkok, Thailand. The Assembly brought together leaders from business, finance, civil society and governments to workshop the contributions of businesses to the United Nations Sustainable Development Goals (SDGs).

For the first time, as part of the Assembly we hosted a dedicated Finance Day, focusing on how financial institutions can engage companies on sustainability priorities and unlock sustainable business in Asia. The Day included two main sessions: the first explored how investors can use their stewardship activities to unlock sustainable business in Asia, while the second delved into how finance can support and accelerate regional decarbonisation plans. Participants – financial services practitioners, policymakers and others – shared a wealth of knowledge on these topics, with three of the key takeaways being the need to leverage global engagement techniques to meet local needs; the importance of multi-stakeholder collaboration, and how to better engage financial institutions and companies on sustainability-focused discussions.

1. Leveraging global engagement techniques in a local context

The first key theme coming out of discussions was the need for localised approaches to investor engagement in Asia. These should take into account the region’s diversity, the nascent state of unifying and enforceable policy frameworks, and the more recent focus on sustainability. Participants also highlighted the need to understand the engagement-related relationship with, and perspective of, SMEs in the region. And, panellists discussed the importance of linking financial materiality to sustainability factors to catalyse a positive long term virtuous circle, and that better training and education can help facilitate this amongst regional investors.

On this topic and others, capacity building and sharing successful case studies were deemed essential for sustainable growth in the region. Nana Li (Head of Sustainability and Stewardship, Asia Pacific at Impax Asset Management) also pointed out that while regional differences are crucial, fundamentally the core of investor stewardship worldwide remains to “get the message across to senior leaders in companies to be good stewards and care.”

2. Multi-stakeholder collaboration

Multi-stakeholder collaborations were hailed as a crucial strategy for Asian sustainability-minded investors and businesses, with key areas of focus including credible transition plans. The creation of regional working groups to help ensure companies have accessible toolkits and peer-learning networks was highlighted as another important area for collaboration. More generally, as mentioned by Charles Nguyen (Head of ESG Asia, Neuberger Berman), capacity building was seen by participants as the most important area of focus in Asia – this was seen as helping facilitate informed discussions on topics such as transition plans, and empowering actors to demonstrate through analytical work, the potential for positive financial returns associated with the transition. Finally, in addition to action from finance and business, civil society organizations and research institutions can play significant roles in developing insights and training programmes, while important initiatives such as Glasgow Financial Alliance for Net Zero (GFANZ)’s work and WBA’s ACT Methodology were also seen as helpful.

3. The financial institution – company relationship

Finally, participants homed in on the foundational element of investor engagement – building a successful and productive relationship between financial institutions and companies. Panellists shared real life-examples of successful relationships, and the tools available for asset managers and asset owners that can help build these relationships. Panellists also shared the practical steps investors can take, including allocating capital to responsible actors and advocating for policy development to align local agendas with global standards, to help drive positive change. Building a mutual understanding between investors and companies can take time, as stressed by Kurt Metzger (Energy Transition Director, Asia Research and Engagement). However, panellists including Trista Chen (Head of Investment Stewardship Asia at Legal and General Investment Management) also noted that sometimes escalation measures are needed and this can include co-filing shareholder resolutions. As an example of best practice engagement between investors and financial institutions, participants including Vivi Siriporn (Founder of the 30×30 Thailand Coalition) and Art Satjipanon (Thailand Country Coordinator, WE4F program) celebrated the launch of WBA’s Nature Investor Statement, calling investors to action on nature-related engagement with companies. And, participants also explored the importance of policy engagement in shaping global sustainability standards, through a dedicated session on the Taskforce on Inequality and Social-related Financial Disclosures (TISFD).

Our next steps

Overall we were extremely pleased with the productive discussions and learnings at Finance Day, and want to thank all the participants for their contributions. We hope that the sessions will help attendees stay ahead of trends, understand regional priorities, and contribute to shaping a sustainable future in Asia. We strongly encourage both Allies and non-Allies who missed this session to join future events – we will be hosting events at forthcoming key moments in the latter half of 2024, including at COP 29 and New York Climate Week. If you’re interested in connecting or working with us at these fora, please do reach out to g.mason@worldbenchmarkingalliance.org.