Key finding

Companies see an electric future, but their ambitions are low (2020)

20 out of 30 companies do not have publicly available vehicle in-use emissions reduction targets with a meaningful timeframe. Amongst those who do, just half are sufficiently ambitious enough to meet their well below 2-degree pathway.

Decarbonising the automotive manufacturing sector is critical to achieve the Paris Agreement’s goals of holding temperatures to well below 2 degrees and pursuing efforts to limit the temperature increase even further to 1.5 degrees. Zero emission transport is high on the agenda at the next UN Climate Change Conference (COP26). Moreover, the UK government, COP26’s host, is targeting an ICE phaseout by 2035 with discussions underway to bring the timeframe forward to 2030, in line with other countries’ aims such as Germany, Ireland and the Netherlands.

Given that most emissions from the automotive sector occur while vehicles are in use through the combustion of fossil fuels in internal combustion engines (ICE), automotive manufacturers must drive rapid reductions in their vehicle in-use emissions by shifting towards low-carbon vehicles, such as plug-in hybrid, battery electric and fuel cell electric vehicles. Conventional hybrid vehicles are not considered low-carbon by this assessment as they have limited impact in reducing emissions.

Targets to reduce emissions

To achieve the low-carbon transition, automotive manufacturers need to set long-term emissions reduction targets along with short-term milestones across their entire value chain. These targets should be science based and publicly reported.

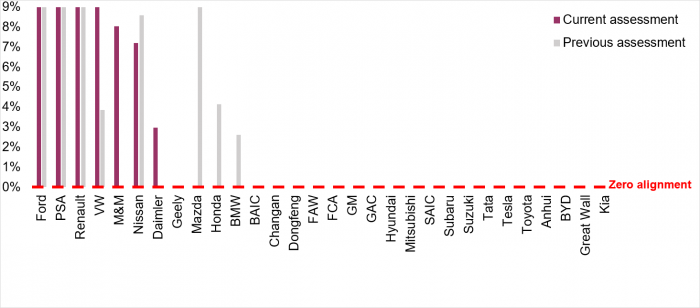

However, of the 30 companies included in this 2020 Automotive Performance Update, eight companies report sufficiently clear vehicle in-use emissions reduction targets for assessment, with only five companies fully aligning with their well below 2-degree pathway: PSA, Renault, Ford, Volkswagen and Mahindra & Mahindra (Figure 1). An additional two companies state they have set vehicle in-use emissions reduction targets but do not disclose enough information to be assessed on their alignment. The remaining 20 companies have not published any medium to long-term vehicle in-use emissions reduction targets.

Figure 1: Performance on vehicle in-use emissions target alignment. 9 percent represents full alignment in this assessment.

When comparing companies’ 2020 performance on vehicle-in use emissions target alignment under their well below 2-degree pathways with their alignment under their 2-degree pathways in the 2019 assessment, four companies were found to have worsened in alignment. Only three companies’ performances have improved:

- Volkswagen set a vehicle in-use emissions reduction target that has been validated by the Science Based Targets initiative (SBTi) as aligned with the well below 2-degree pathway and set to be achieved by 2030.

- Daimler’s and Geely’s performance also improved due to ambitious SBTi-validated vehicle in-use emissions reduction targets set by their respective subsidiaries Mercedes-Benz and Volvo Cars. However, these companies only receive a partial performance score as their targets do not cover all vehicles under the parent companies. Transformative change must be embedded across the whole group rather than relying on subsidiaries to drive the low-carbon transition.

Manufacturing emissions are easier for companies to address but are far less significant in terms of overall emissions from the automotive sector. Nearly twice as many companies assessed have set manufacturing emissions reduction targets than they have for their vehicle in-use emissions. This is a similar trend as was seen during the 2019 assessment. Nonetheless, the more ambitious well below 2-degree scenario used in the 2020 assessment resulted in only four companies setting manufacturing emissions targets which are fully aligned with their decarbonisation pathway compared to nine companies in 2019 under the 2-degree scenario. Companies need to proactively become more ambitious regarding both their manufacturing and vehicle in-use emissions reduction targets to align with the extensive requirements of the increasingly urgent climate efforts. Once available in the 1.5-degree scenario, the Climate and Energy Benchmark will use it for future assessments. This scenario is expected to reveal the need for even greater targets and efforts.

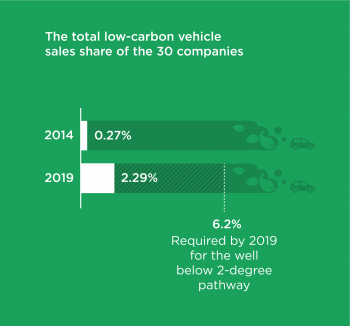

Ambitions for low-carbon sales

Under the IEA’s Net Zero Emissions by 2050 case, low-carbon vehicles should account for 58 percent of passenger vehicle and light truck sales by 2030. Most vehicles currently sold will still be on the road in ten years’ time meaning that the levels of carbon locked in from continuing to sell ICE vehicles will remain significant for the automotive sector. The time to act is now. By increasing their low-carbon vehicle sales ambitions, automotive companies can signal and catalyse a shift towards decarbonisation in the sector. While few of the companies assessed commit to ambitious vehicle in-use emissions reductions, 17 companies have committed to increase their low-carbon vehicle sales. However, only one of the conventional automotive manufacturers – a company that entered the market manufacturing conventional ICE vehicles – has committed to a total ICE phaseout. Chinese company Chongqing Changan, known for the Eado model, aims to end the sale of ICE vehicles by 2025, though it is questionable whether this will be achieved given that ICE vehicles accounted for 97 percent of the company’s sales in 2019.

Several companies have set targets to increase their share of sales from low-carbon vehicles within specific timeframes:

- Daimler and BMW aim for low-carbon vehicles to account for half of their total sales by 2030.

- Groupe PSA aims for low-carbon vehicles to account for half of its total sales by 2035.

- Volkswagen and Subaru aim for low-carbon vehicles to account for 40 percent of their total sales by 2030.

Other companies assessed, including Nissan, General Motors and Hyundai, have set targets to increase their low-carbon vehicles sales in absolute terms. While these types of commitments are steps in the right direction, failing to establish targets regarding future low-carbon vehicle sales as a share of total sales also leaves room for ICE vehicle sales to grow.

Investments, transparent planning and management incentives to scale-up

Companies should back their commitments to increase low-carbon vehicle sales and reduce emissions with relevant investment activities, transparent transition plans and robust management incentives to sustain progress. Equally, companies’ investments in low-carbon vehicles should be upheld by public low-carbon commitments, planning and reporting to assure investors and other stakeholders of their commitment to the low-carbon transition.

A number of the companies assessed are adopting various investment approaches to scale up their low-carbon vehicle production:

- BMW is developing flexible platforms that allow any model to be produced with any type of powertrain.

- General Motors has announced a US$20 billion investment in capital and engineering resources towards electric vehicle and autonomous vehicle programmes between 2020 and 2025.

Tesla, BYD and Anhui have also invested significant amounts in low-carbon vehicle manufacturing and play a positive role in disrupting the market, with low-carbon vehicles accounting for a large share of their total sales. However, disruptors such as these companies cannot not lead the low-carbon transition unless they drive transparency as well. They also need to commit to – as well as publicly report on – decreasing emissions in other parts of their value chain, including from suppliers and other upstream and manufacturing sources, to inform stakeholders of their plans and increase accountability. None of the other companies headquartered in China have made public commitments to increase low-carbon vehicle sales, despite share of sales from these vehicles having increased for several Chinese companies during the assessment period.

The assessment also indicates that executive leadership may not be sufficiently incentivised to deliver on their companies’ low-carbon plans. The average performance on management incentives decreased by 50 percent compared to the 2019 assessment partly due to the more ambitious scenario and because more robust evidence was sought to confirm the significance of the incentives. Groupe PSA is one example of good practice where incentive schemes are clearly stated in the company’s annual report and include payment of variable compensation for the managing board and employees that is conditional on the carbon dioxide emission levels of vehicles sold in Europe, which account for more than 85 percent of the company’s total sales. Nonetheless, Groupe PSA has room for improvement on its sold product performance, illustrating that strong incentives do not always translate to the largest emissions reductions.