A tale of two automotive companies: sluggish incumbents and opaque disruptors in the race to zero-emissions vehicles

Written by: Ben Gilbey, Senior Technical Officer, ACT Initiative, CDP

No emissions targets, unclear climate change strategies and little disclosure on low-carbon R&D. These sound like the characteristics of a company selling very few low-emissions vehicles. However, the 2020 Performance Update of the Automotive Benchmark produced by CDP and the World Benchmarking Alliance showed the opposite. The companies selling the highest proportion of low-carbon vehicles in their fleets, such as Tesla and Chinese companies BYD and JAC Motors, publicly disclose very little on their emissions or climate change strategies.

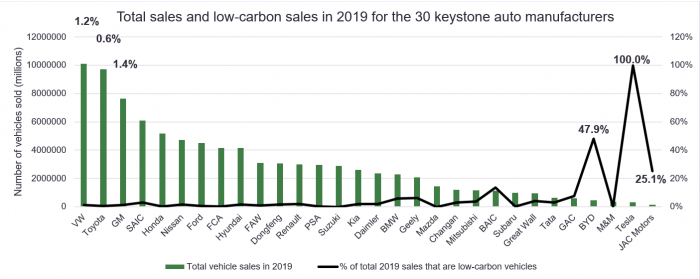

In contrast, the three biggest auto companies by number of vehicles sold in 2019 – Volkswagen, Toyota and General Motors – disclose substantial detail on their emissions and climate strategies, but have made very slow progress in increasing their share of low-carbon vehicle sales. Battery electric, fuel cell and plug-in hybrids accounted for only 1.2 percent of Volkswagen’s sales, 0.6 percent of Toyota’s and 1.4 percent of General Motor’s. This is significant for global emissions when you consider the total vehicle sales of these incumbents still dwarfs many of the newer, disruptive companies as shown in Figure 1. For example, Volkswagen sold over 10 million vehicles in 2019, whilst Tesla sold 3 percent of that amount.

Figure 1

The incumbents sluggish progress in increasing low-carbon vehicles sales suggests they have not fully committed to a shift away from the internal combustion engine. This is illustrated by their approach to policy engagement – all three companies are key members of trade associations that have opposed regulation to reduce tailpipe emissions. This is likely because such regulation may create additional costs for petrol and diesel vehicle production. Marketing strategies and purchasing incentives of most automakers also continue to focus on petrol and diesel vehicles, with 16 of the 30 companies assessed found to have no programmes to promote low-carbon vehicle sales.

This year has seen Tesla’s market capitalization surpass Toyota’s to become the highest of any automaker in the world. Other disruptors are seeing similarly high valuations, with BYD becoming the world’s fourth-largest automobile company by market value in November. In this context, there are signs that incumbent automakers are finally ramping up for large increases in their low-carbon vehicle sales.

Volkswagen is aiming for 40% of its sales to be low-carbon vehicles by 2030 –equivalent to 4 million vehicles if it maintains total sales of 10 million. Subaru has also set a target for a 40% low-carbon vehicle sales share by 2030, Daimler and BMW are aiming for 50% by 2030 whilst Groupe PSA is aiming for 50% by 2035. Nissan, General Motors and Hyundai have also set targets to increase their low-carbon vehicle sales in absolute terms.

Such commitments are enabled by a political context which is increasingly supportive of investment in low-carbon vehicles. For example, GM’s recent boost of its investment plan for electric and autonomous vehicles from US$20 billion to US$27 billion followed the election of President-elect Biden in the USA. Likewise, the company has dropped its support for the Trump administration’s legal challenge to California’s tailpipe emissions standards, with The Hill reporting GM stating “We are confident that the Biden administration, California, and the U.S. auto industry, which supports 10.3 million jobs, can collaboratively find the pathway that will deliver an all-electric future.”

Whilst the majority of the automotive sector’s emissions impact comes from the burning of gasoline or diesel in internal combustion engines, manufacturing emissions (scope 1 and 2) are also substantial and under the direct control of the companies. Many of the incumbents scored highly in this area of the assessment, having made progress through purchasing renewable electricity and efficiency improvements. In contrast, Tesla, BYD and JAC Motors scored 0% in this area, with very little transparency around emissions. Despite stating in its 2018 impact report that it would begin accounting for emissions from the year 2017 onwards, Tesla failed to disclose its scope 1 and 2 emissions in 2018 and 2019. Stakeholders are increasingly taking notice of this lack of transparency, with investors worth US$20 trillion recently calling on companies including Tesla to disclose emissions and set 1.5 degree-aligned emissions targets through the Science-Based Targets initiative.

Auto manufacturers occupy a keystone role in global supply chains and can use their purchasing power to drive emissions reductions in steel, leather, battery and other industries. Incumbents outperformed disruptors in this area. BYD and Tesla have supplier codes of conduct but lack a clear strategy to reduce emissions in their supply chain. On the other hand, several incumbents collect information on emissions from suppliers and build capacity to implement emissions reductions, for example through the CDP Supply Chain programme.

Different lessons therefore emerged from this assessment for incumbents and disruptors. For incumbents, the priority has to be rapidly scaling up low-carbon vehicle sales. This will both reduce their emissions impact and enable them to stay relevant in a world in which investors, regulators and consumers are increasing demanding more electric vehicles and the phase-out of the internal combustion engine. For disruptors such as Tesla, BYD and JAC Motors to fulfil the hype and achieve future vehicle sales on the same scale as Volkswagen, General Motors and Toyota, much greater transparency will be needed. Setting emissions targets for upstream emissions and manufacturing emissions can help disruptors prove they truly are the future leaders of a low-carbon economy.