Case study

Case study

Introduction

Following our benchmarking exercise for 100 keystone companies in the oil and gas industry, we asked the following question: What are companies’ impacts in their regions, and how do these companies keep up with the regional targets and road maps for a low-carbon transition?

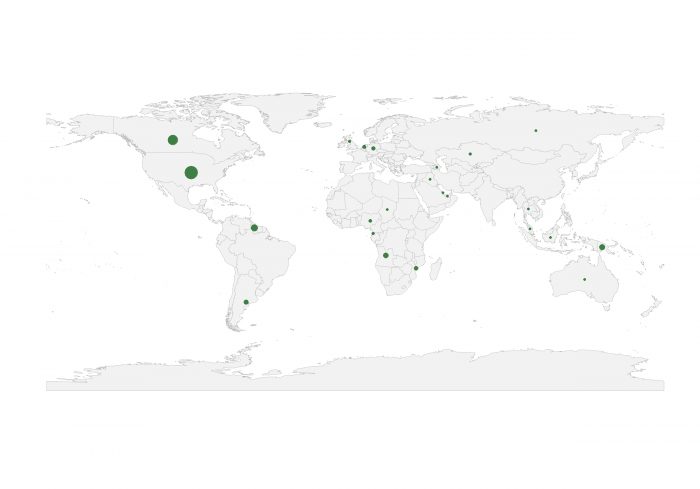

We narrowed down the scope of companies for an in-depth look at their footprints in the regions where they operate. To make sure the companies included are widely representative, we considered company size, ownership structure, headquarter location and data availability. Using all these criteria, we selected following 5 companies to be included in our case study, Ecopetrol, Exxon Mobil, OMV, Origin Energy and Pertamina, with good representation for Europe, North America, South America, and Asia-Pacific.

Focusing on these five influential companies within their regional context, we highlight their sizes in terms of employees and number of operating locations, and we ask the question: how can they further influence action in the industry and in their region by their peers? We also share our learning from these companies and outline their ambition for the low-carbon transition. Taking national targets and goals into account, we give insight into the alignment between the ambitions of these companies and their countries.

Ecopetrol

Ecopetrol is the largest primary oil and gas company in Colombia, and one of the four principal petroleum companies in Latin America.

Exxon Mobil

Exxon Mobil is one of the world’s largest companies by revenue and is headquartered in the USA. With its vast global presence, its impact is not only limited to the USA but is evident worldwide.

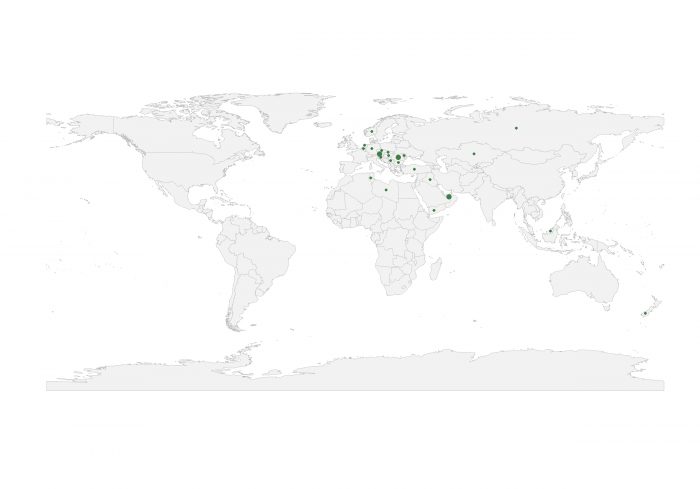

OMV

One of the largest publicly listed companies in Austria, OMV has oil and gas operations in various countries across Europe.

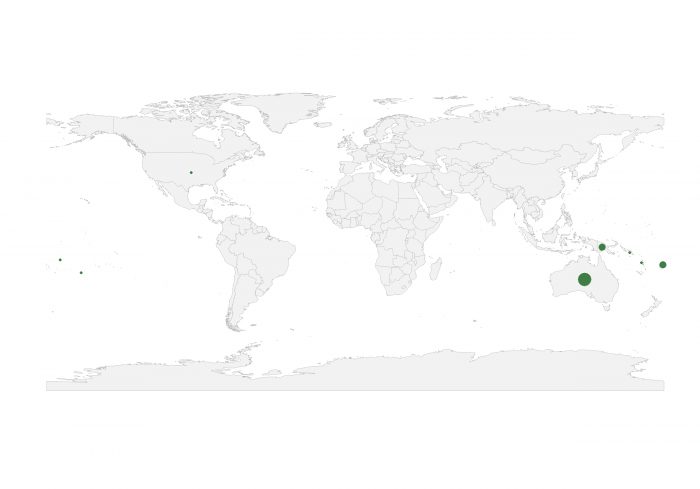

Origin Energy

Headquartered in Australia, Origin Energy mainly operates within the country, with business activities in neighbouring island countries. Origin was included in WBA’s Electric Utilities Benchmark last year for its electricity business.

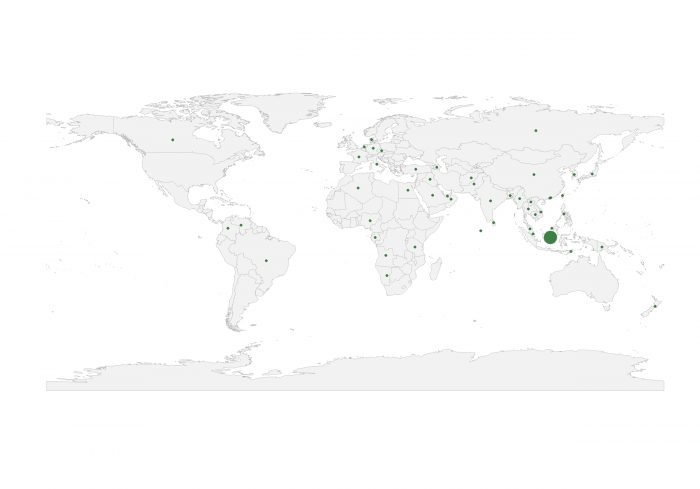

Pertamina

As the largest primary oil and gas company in Indonesia, Pertamina is a major player in Indonesia’s industry and serves the daily energy demand of the world’s fourth largest population.

Snapshot of alignment of targets and regional policy

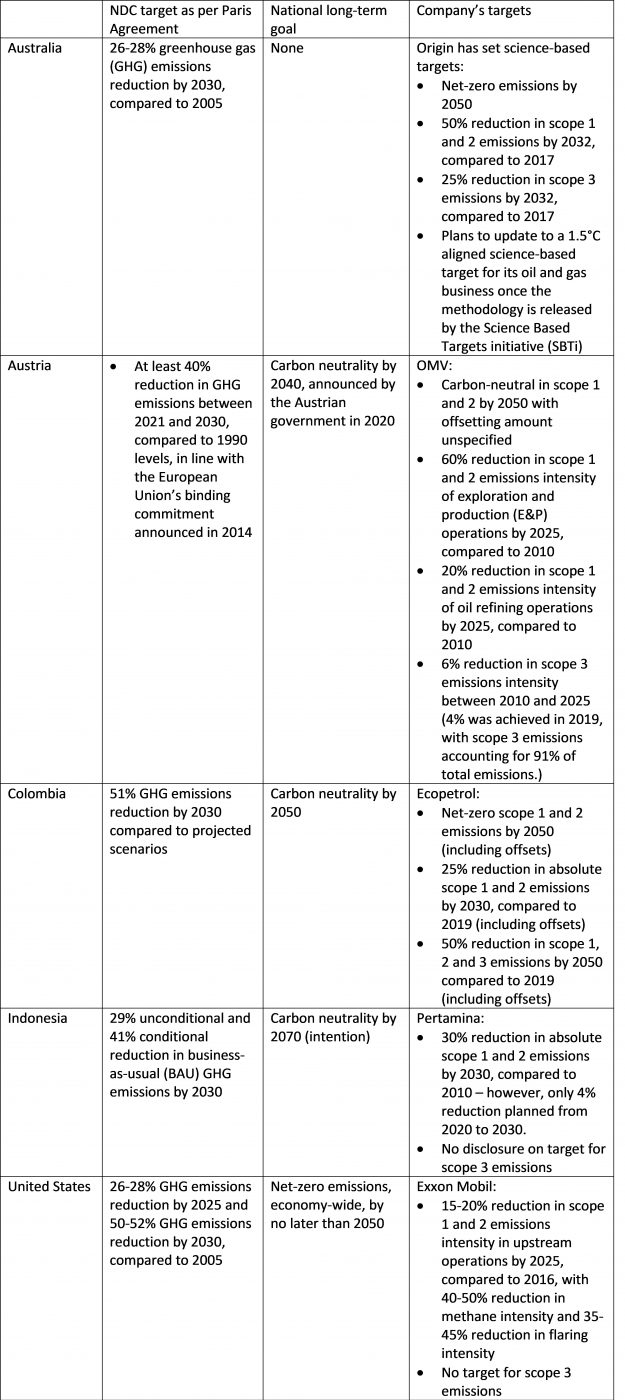

Considering the widely distributed operations of the oil and gas companies, and their great impact on local economy, it is critical to understand whether they are driving on a low-carbon transition pathway that aligned with the regions’ ambitions where they operate. This table gives you a snapshot of how these five companies are faring in terms of their decarbonisation ambition within the regional context.

In this table, we outline the regional climate policies in the five countries where the companies are headquartered. We provide an overview of the countries’ current nationally determined contribution (NDC) targets as per the Paris Agreement, as well as government-led national, long-term decarbonisation goals. Next to this, on the right side of the table, we show the companies’ decarbonisation plans, which were analysed in our benchmark using ACT methodologies to understand their readiness for the low-carbon transition.

These comparisons clearly show how there are different levels of alignment between the targets of the oil and gas companies and the decarbonisation plans of their headquartered countries.

OMV has set targets to reduce its scope 1 and 2 emissions intensity by 60% and 25% for its E&P and refining operations respectively. However, the company lacks an emissions reduction plan aligned with the 1.5°C scenario for its scope 3 emissions, which made up 91% of its total emissions in 2019. The company sets its target to be carbon-neutral by 2050 for its scope 1 and 2 emission. This is not aligned with Austria’s national target and long-term goal to be carbon neutral by 2040.

While Pertamina sets its target to reduce 30% of its absolute scope 1 and 2 targets by 2030 compared to 2010, it only plans to reduce 4% of its absolute scope 1 and 2 emissions by 2030 compared to 2020. This target is not aligned with a 1.5°C scenario. Moreover, the company has not yet reported a target for its scope 3 emissions. Meanwhile, Indonesia shows lack of ambition in its own decarbonisation goal and needs to ramp up its national-level plan for the low-carbon transition.

Origin goes further in its decarbonisation plans than its country of headquarters. Origin has initiated its low-carbon journey by setting science-based targets, and now plans to upgrade its target to also align with a 1.5°C pathway. At the same time, the company aims to be net-zero by 2050. However, Australia has not yet published a long-term decarbonisation goal for the country.

Ecopetrol targets to achieve a 50% reduction in scope 1, 2 and 3 emissions by 2050, and carbon neutrality in scope 1 and 2 emissions by 2050. However, this target still lags behind Colombia’s national ambition to be entirely carbon neutral by 2050. As the largest primary oil and gas company in Colombia, Ecopetrol will need to step up its efforts and play a key role in the nation’s low-carbon transition.

Exxon Mobil shows a lack of ambition in its target-setting. Though Exxon Mobil plans to reduce its scope 1 and 2 emissions intensity by 15 -20% by 2025 compared to 2016, the company’s target does not align with the pathway recommended by the science-based targets. The company also doesn’t cover its scope 3 emissions in its target, even though these are a major component of its total emissions. Exxon Mobil’s goal also does not align with the ambition of its country, USA, to become carbon neutral by 2050. As one of the world’s largest companies, Exxon Mobil has a vital role to play in achieving a low-carbon economy, not only in the USA but, given its wide global presence, across the world.

Call for action

These five companies provide a snapshot of the wide impact that oil and gas companies have within the countries where they operate as well as globally. They show how oil and gas companies are significant in their regions and internationally in terms of their subsidiaries and the number of people they employ, as well as considering the scale and reach of their operations. These companies have a big influence on the regional and world economies and thus they have a crucial role to play in achieving the low-carbon transition of economies.

The comparisons of targets between companies and between the company and the country where it operates, show that there remain opportunities for companies to improve their low-carbon performance. Setting up specific targets for scope 3 emissions reductions, which is one of the biggest emissions source for oil and gas companies, constitutes one notable area for improvement. The findings from our benchmark assessment show that most oil and gas companies are still not in line with their targets and ambitions to achieve a low-carbon transition that meets the 1.5°C scenario. Their targets need to be stepped up, their commitments need to be made firmer.

Given that oil and gas is a high-emitting industry in every country’s economic portfolio, it is also essential for both companies and countries to work towards better alignment in their decarbonisation plans. We hope the cases of Ecopetrol, Exxon Mobil, OMV, Origin Energy and Pertamina will form the basis for greater engagement between these influential companies and national governments, as well as between companies and their allies and stakeholders in the locations where they operate.

WBA will continue to disseminate the data and key findings of the global Oil and Gas Benchmark at country and regional levels by convening dialogues, contributing to policy development and engaging directly with the companies, as we’ve done during the benchmark development and the publication cycle. If we are to activate effective action on the low-carbon transition, it’s imperative that corporate and government ambitions for the decarbonisation of our energy systems are aligned, and it’s imperative for us all to play our role.

References:

https://iea.blob.core.windows.net/assets/4719e321-6d3d-41a2-bd6b-461ad2f850a8/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf

https://www.ft.com/content/2bf04fff-5b2f-4d96-a4ea-ff55e029f18e