Key finding

The great disruptor can energise the low-carbon transition

Targeted R&D offers bright future for companies willing to invest.

Research and development (R&D) into technologies with significant potential to mitigate climate change is pivotal for the decarbonisation of the electric utilities sector. To demonstrate sufficient financial commitment to the innovation required, electric utilities need to direct significant capital to low-carbon R&D. However, reporting of such investment was only found for 24 of the 50 companies. Of these, only 14 provide some breakdown of the investment by mature and non-mature (emerging) technologies, and 16 invest less than 2% of capital expenditure in low-carbon R&D. Fortum performs well, investing 7.5% in low-carbon R&D in 2019, as does Engie, thanks to its clear investments in non-mature, low-carbon technologies.

These figures indicate that companies are not investing enough in low-carbon R&D, limiting their ability to decarbonise and realise new low-carbon value. The International Energy Agency reports that non-traditional energy companies are increasingly investing in low-carbon R&D, raising the risk that incumbent electric utilities will miss out on new business opportunities.

Maturity of low-carbon business models.

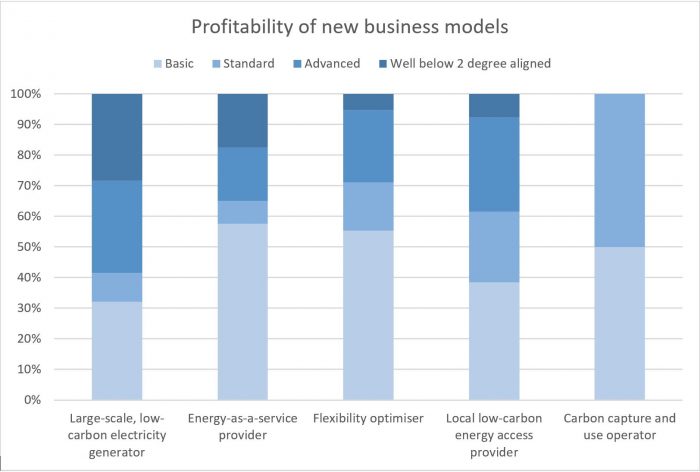

The assessment also evaluated the maturity of five new low-carbon business models being developed by the companies in this sample. Information was often limited, but data found on profitability, business size, projected growth and deployment schedules suggest these models are still only a small part of the companies’ overall business. This is due in part to limited low-carbon R&D investment.

- The ‘large-scale, low-carbon electricity generator’ business model has the greatest potential to enable decarbonisation and is the most common and mature low-carbon model being pursued. The focus is on increasing renewables, with 19 companies setting renewable capacity targets. Ørsted demonstrates the financial opportunity this model offers, with its wind and solar earnings growing by 32% annually between 2017 and 2019.

- ‘Energy-as-a-service provider’ is the joint second most common business model alongside ‘flexibility optimisation’. This model includes provision of services such as energy performance contracts or smart management. For example, E.ON is shifting away from electricity generation towards energy services and grid management. However, companies simply selling off high-emitting assets so that other entities must decarbonise electricity generation will not enable the required decarbonisation of the entire electricity system. For most of the electric utilities assessed, the provision of energy services will be an addition to, rather than a replacement of, their generation business, and the key focus for the sector remains the decarbonisation of generation.

- In the grid ‘flexibility optimisation’ business model, technology and infrastructure enable more renewable electricity and electric vehicles to be used. This model is less mature than energy-as-a service provider. Some companies are developing battery storage, such as Vistra’s 300 MW battery energy storage project, which is reportedly the largest of its type in the world. Examples of electric vehicle charging infrastructure and services include Fortum Charge and Drive, which currently has 4,000 chargers and 125,000 customers. Check out the Automotive Benchmark to explore the overlap of new business models across the electric utilities and automotive sectors.

- The ‘local low-carbon energy access provider’ business model, offering products and services such as micro-grids to enable community-based renewables, has only been adopted by a few companies and is a small part of their business. This signals that electric utilities still have far to go in providing universal access to sustainable energy. For example, Malaysia’s Tenaga Nasional has established a Net Energy Metering scheme to pay customers to connect small-scale solar PV projects. 74.5 MW capacity is to be connected, equivalent to only 0.49% of the company’s total capacity.

- The least common and mature business model is the ‘carbon capture and usage operator’, which is focused on developing carbon capture and storage (CCS) technology to reduce fossil fuel emissions and/or utilise captured carbon in industrial processes. Many companies refer to CCS in their transition plan, but the assessment found no information suggesting this business model is profitable or of a substantial size. In the long term, CCS technology may help the sector to reach negative emissions, which 46 of the 50 companies must do by 2050 under the well-below 2-degree decarbonisation scenario. However, this can only be achieved if CCS is rolled out at scale, meaning companies should invest further in CCS and other non-mature technologies to enable decarbonisation of the whole electricity system.